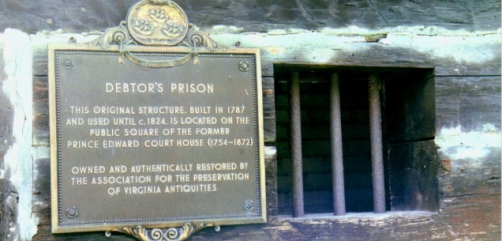

Back in the day, if you owed me money, I could imprison you. Sure, its mostly illegal today, I can sue you, I can get a judgement against you, but I can't have you arrested, placed in a sweatshop to pay me the judgement and the cost of having you be there. But, its still legal, its still in use, it is still happening, everyday in the United States.

The most obvious of these are people who are jailed because they have not, or cannot pay child support, court fines or fees, and restitution as ordered by the court. While, I am no fan of the practice, it is what it is. For the rest of us who have debt, we are all still incarcerated. Once debt is incurred you have to be extremely frugal with the money you earn or generate, or lucky, but the truth is, you need to be both. Otherwise, you have options, specifically Chapter 7 Bankruptcy or Chapter 13 Bankruptcy. Credit scores mean the difference between getting that really nice job, a better interest rate on your car payment, loan, credit cards, mortgage, lower down payments when one is required, and lower rates on your car insurance. I could go on forever about all the little things that number can help or hurt you with.

I didn't want to get into what both of these types of bankruptcy are, but I will briefly. A Chapter 13 is a reorganization of debt, basically it stops the creditors from making your life hell, while you pay the court, they pay the bills until you are all paid up. A Chapter 7 is basically a fire sale of "nonexempt property", in which your debt is paid by your creditors buying said property, and if you have no nonexempt property, they get nothing. However, the fee for both is mostly nominal depending on what you earn in an hour, and how many hours a week you work. It is roughly $330 for a chapter 7, and could be up to the same for a chapter 13. You can pay in payments, if you can show that your situation is dire enough, and the trustee is merciful. There are also legal costs that you will have to pay, because you will need a lawyer, because both of these debt relief options are fairly intricate.

Even with both types of bankruptcy (and you may file for a chapter 7 and be forced into a chapter 13), there are certain debts that you cannot work around using these so called protections. Now I was surprised to see medical bills on the list of things you can discharge, however if the trustee feels there is fraud or misconduct on your behalf, you still have those hanging over your head. I swore they changed that in 2005 or so. As it is today there are nineteen (19), but the biggies are taxes (understandable to some extent), student loans (case pending before the courts), and homeowner association fees. The biggie list is the same for both types of bankruptcy. Again, I have no real issue with many of these debts that cannot be discharged, you owe child support, yeah, you shouldn't be allowed to bankrupt that. Now a little known fact is the following, even if you swing either bankruptcy, you are not free and clear for up to 7 years.

So, how does debt today equate to a debtors prison you ask? Simple enough. Just about everything in our lives is dictated by a number, three sets actually. Bankruptcy, even when discharged is reflected in those numbers. Some debts cannot be discharged, and honestly, if the trustee is just in a really bad mood that day, he can say no nothing gets discharged and you are out of a lot more than $300. If you have debt of any kind (medical bills, student loans, etc) are in debtors prison of a new design. Get into debt because of ~insert reason~ your life gets held ransom. Jobs that could help you drag yourself out go away because of a flawed mindset, or because you were arrested and incarcerated (oh, the things that go wrong once you have been locked up for a week or two even if you managed to get that decent paying job). You incur more debt because you pay more in terms of interest, down payments and insurance.

But this new debtors prison is far more insidious than what we had in the United States before. You see, back in the day, they would just put you in a work camp. You worked until your debt was paid, and you were squared up with the state, then you were free to go. Today, you are never really free (well unless you can get everything squared away and keep it there for seven to ten years). The way it works now, the system is designed to get you broke and keep you there. Was it intentional, yes and no. I will field the no part first. The system wasn't designed to keep people totally broke, because totally broke people cannot pay bills, they do everything they can to limit their increases to debt. As for yes, there is more profit in keeping people broke enough that they have to pay more for everything. This debtors prison doesn't lock you away in a cage, well most of us anyway. But it robs you of your ability to live to your full potential, and denies you the right to not only pursue happiness, but to achieve it as well.

A blog about charities, politics, and other events that occur. Feel free to share anything stated on this blog. Who knows where the journey will lead us.

Subscribe to:

Post Comments (Atom)

3 years later...

Yay, I quit smoking. I moved around a bit. I saw Covid19 and survived. I even got vaccinated for it, and outside of some really weird dr...

-

Yay, I quit smoking. I moved around a bit. I saw Covid19 and survived. I even got vaccinated for it, and outside of some really weird dr...

-

Many years ago I was told "If you know what you have, you don't have much." The comment, made by a friend really rubbed me th...

-

I am not a fan of banning books, nor am I of burning them. If not for the time and effort put into them by the authors, their creators, ...

No comments:

Post a Comment